PropNex Picks

|January 08,2025New record: More than 1,000 million-dollar resale flats sold in 2024

Share this article:

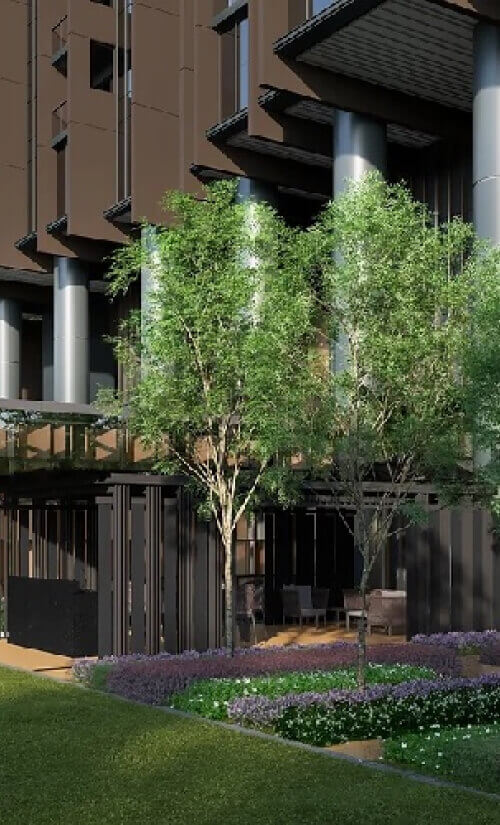

Another year, another new record set for the number of million-dollar resale flats sold. In 2024, there were 1,035 flats that were resold for at least $1 million, marking an all-time high for such transactions.

The record for such sales has been rewritten time and again since 2020 where 82 flats changed hands for $1 million or more each. Then it hit three-digit numbers in 2021 to 2023, and breached the 1,000-unit level in 2024 (see Chart 1). The 1,035 units resold in 2024 have more than doubled the 469 million-dollar flats sold in 2023. PropNex expects that the number of such flats sold to remain elevated in 2025 - more on this later.

What was once a rare occurrence (e.g. below 10 transactions a year in 2012 to 2014) is happening with more regularity these days, and will be a new normal in the HDB resale landscape going forward. That said, million-dollar resale flats still accounted for a small portion of the total resale flat volume, at around 3.7% in 2024.

Chart 1: Number of HDB flats resold for at least $1 million

Profiling 2024's million-dollar resale flats

Breaking down the transaction data, the town with the highest number of million-dollar resale flats sold in 2024 was Kallang Whampoa, with 156 deals. Kallang Whampoa has never led such sales prior to 2024. Of the 156 units, about 43% of them are located at St. George's Towers in St. Geroge's Lane which had recently exited the 5-year minimum occupation period (MOP).

Following Kallang Whampoa, mature town Toa Payoh was in second place with 144 flats resold for at least $1 million in 2024. Among them, 31% of the units have a lease balance of 94 years or more, including 24 units at the recently MOPed Alkaff Vista in Bidadari Park Drive.

In third place was Bukit Merah, which garnered 135 million-dollar resale flat deals in 2024, while Queenstown had 109 such transactions. In July, a 5-room unit in Margaret Drive in Queenstown became the priciest resale flat ever sold when it fetched about $1.73 million - the transaction was not reflected in the sales data as the block is less than 5 years old at the time of sale.

By flat type, the million-dollar resale flats sold in 2024 comprised four 3-room flats (all Terrace), 381 units of 4-room flats, 392 units of 5-room flats, 254 executive flats, and four multi-gen flats. Of these, the oldest flats sold were the four terrace flats in Kallang Whampoa (Jalan Ma'mor and Jalan Bahagia) which had about 47 years of remaining lease when they were resold in 2024.

Notably, not only has the number of million-dollar resale flats sold grown over the years, the price range of such transactions has also crept higher. For instance, prior to 2021, there were no transactions beyond $1.3 million (see Table 1). Subsequently, there were HDB resale flat deals done at $1.3 million to $1.4 million in 2021, then at $1.4 million to $1.5 million in 2022, and crossing $1.5 million in 2023 and 2024. The upward creep in transacted prices also reflected the overall increase in HDB resale prices over the past years.

Based on the HDB resale price index, resale flat prices have risen for five consecutive years from 2019 to 2023 - with particularly robust growth in 2021 and 2022 where prices rose by 12.7% and 10.4%, respectively. According to flash estimates, HDB resale prices climbed by a cumulative 9.6% in 2024, following a 4.9% growth in 2023.

Table 1: Price range of million-dollar HDB flats resold by year from 2017

Price range | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

$1.0 mil to < $1.1 mil | 40 | 54 | 48 | 57 | 159 | 195 | 262 | 594 |

$1.1 mil to < $1.2 mil | 6 | 17 | 13 | 18 | 60 | 93 | 89 | 213 |

$1.2 mil to < $1.3 mil |

|

| 3 | 7 | 38 | 64 | 70 | 111 |

$1.3 mil to < $1.4 mil |

|

|

|

| 2 | 15 | 29 | 62 |

$1.4 mil to < $1.5 mil |

|

|

|

|

| 2 | 18 | 33 |

$1.5 mil and above |

|

|

|

|

|

| 1 | 22* |

Total | 46 | 71 | 64 | 82 | 259 | 369 | 469 | 1,035 |

Source: PropNex Research, Data.gov.sg (data till 31 Dec) (*figure does not include the $1.73 mil transaction in Queenstown as the block is less than 5 years old at the time of sale, and hence not reflected in the data set)

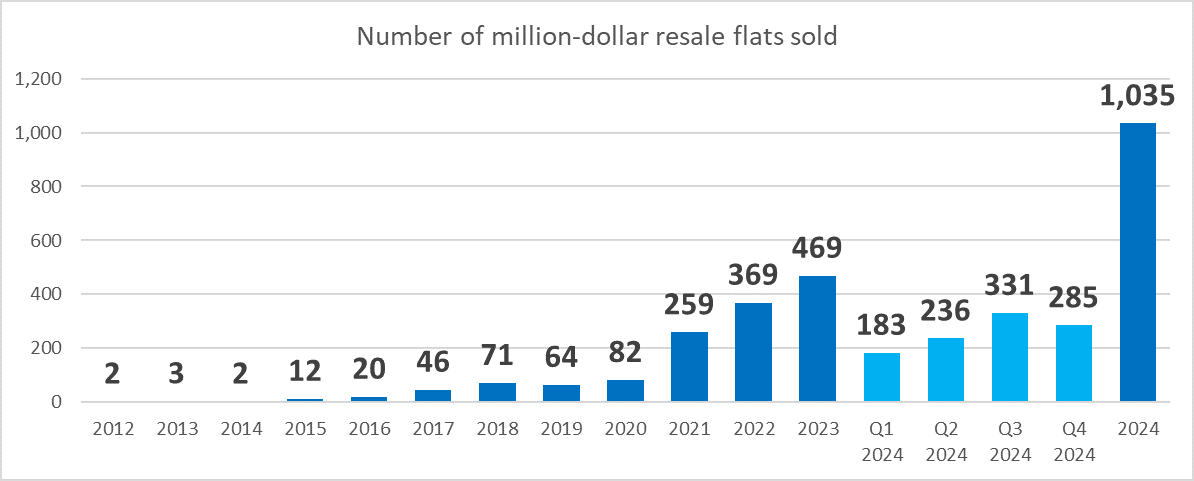

Evaluating the million-dollar flat deals by remaining lease (at time of sale), it is noted that the proportion of units with a lease balance of 94 years or more jumped in 2024 to 13.6% from 6.6% in 2023 (see Chart 2). Many of these flats would have recently exited their respective MOP (including St. George's Towers and Alkaff Vista). Another segment that saw an increase was those with 50 to 59 years lease balance, accounting for nearly 6% of the million-dollar resale flats sold in 2024 compared with 3.8% in 2023. A majority of these older flats are spacious units spanning more than 130 sq m, including maisonettes and jumbo flats.

Chart 2: Proportion of million-dollar resale flats sold by remaining lease

PropNex expects the number of million-dollar resale flats sold could remain elevated in 2025, potentially crossing 1,000 units again, owing to the keen interest for well-located resale flats with unique characteristics. Frequently, the million-dollar resale flats transacted are situated within, or near the city, with convenient access to an MRT station and amenities. They may also be located on a high floor with good views of the surroundings, have a generous floor area, and/or have a lengthier remaining lease. To this end, PropNex estimates that some projects that may hit the 5-year MOP in 2025 - potentially including Clement Crest, Ang Mo Kio Court, and Alkaff Courtview - could likely add to the million-dollar sales tally.

Overall HDB resale market in 2024

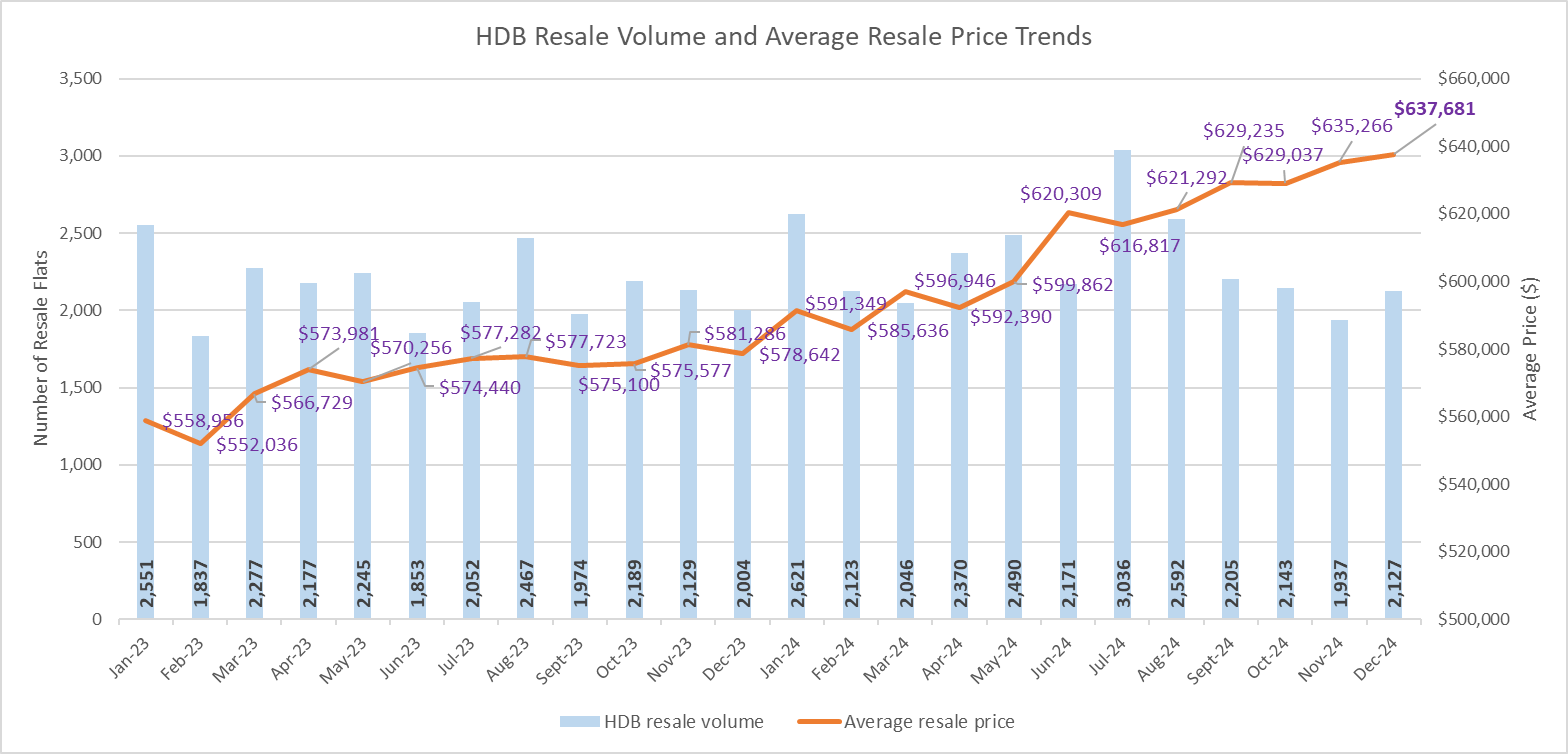

In December, HDB resale volume rose slightly, snapping four straight months of decline. There were 2,127 flats that were resold (see Chart 3), up by 10% from 1,937 units transacted in the previous month, based on sales data. In tandem with the pick-up sales, the average resale price saw modest growth in December - inching up by 0.4% to $637,681 from November's $635,266.

As per the HDB, there were 6,314 HDB resale transactions in Q4 2024 (till 30 Dec), which take the full-year resale volume to an estimated 28,876 flats - up by 8% from the 26,735 flats resold in the whole of 2023. The resale flat volume in Q4 2024 was markedly lower than the 8,142 units sold in the previous quarter.

The weaker sales in Q4 2024 could be due to a combination of reasons, including the year-end seasonal lull where transactions tend to be lower, possibly the impact of the August 2024 measure working its way through the market, as well as the bumper HDB build-to-order (BTO) sales launch in October potentially drawing some would-be buyers from the resale market.

In August 2024, the government introduced a 5 percentage-point reduction in the loan-to-value (LTV) limit for loans granted by the HDB from 80% to 75% - a measure that is aimed at cooling demand and keeping resale flat prices in check.

For the full-year 2025, PropNex projects that HDB resale prices could rise by 5% to 7%, while resale volume may come in at 29,000 to 30,000 units.

Chart 3: HDB resale volume and average resale price

Sign up for the PropNex Property Wealth System Masterclass to unlock opportunities in the real estate market. Contact a PropNex salesperson to find out more about resale HDB market trends.